Chanel just increased its prices on the Classic Flaps the U.S. making it the perfect opportunity for me to write this post about a question I’ve asked myself several times: will Chanel Classic Flaps eventually cost $10K?

I fell in love with Chanel sometime in college, probably during my Sophomore year. Up until then even if I could win a million dollars by stating any fact about “Chanel” I would fail miserably. I went from having zero clue to completely falling in love and vowing to myself that one day I will own a Chanel Classic Flap. After my junior year summer internship in 2011, I contemplated using the money I earned from the summer internship to buy a Chanel Classic Flap but the $3K price tag was a non-starter. There was no way I would pay $3K for a handbag when the most expensive handbag I’ve purchased up to that point was $50 and I was dependent on my parents’ hard-earn money to attend college and I had a bunch of student loans. Not buying a Classic Flap at that time was absolutely the right decision but it also meant I had to pay a lot more for the bag 4 years later.

Long story short, I love Chanel handbags for its unique history, classic design, and outstanding quality. Yet, as much as I love Chanel, I hate price increases, I can’t help but feel somewhat exploited. More and more I find myself questioning whether Chanel Classic Flaps will eventually cost $10K. $10K may sound completely insane on the surface and it is absurd; however, if you really think about it, the price tag doesn’t sound completely unrealistic. In fact, I do think Chanel Classic Flap will cost $10K one day; the question is not if but when.

The rest of the post will go through Chanel’s historic price increases, the famous Chanel Classic Flap vs. the S&P 500 debate, and 5 reasons why Chanel will cost $10K one day. I hope this post will be interesting, entertaining, and potentially thought provoking!

Historical Price Increases – Chanel Classic Flap

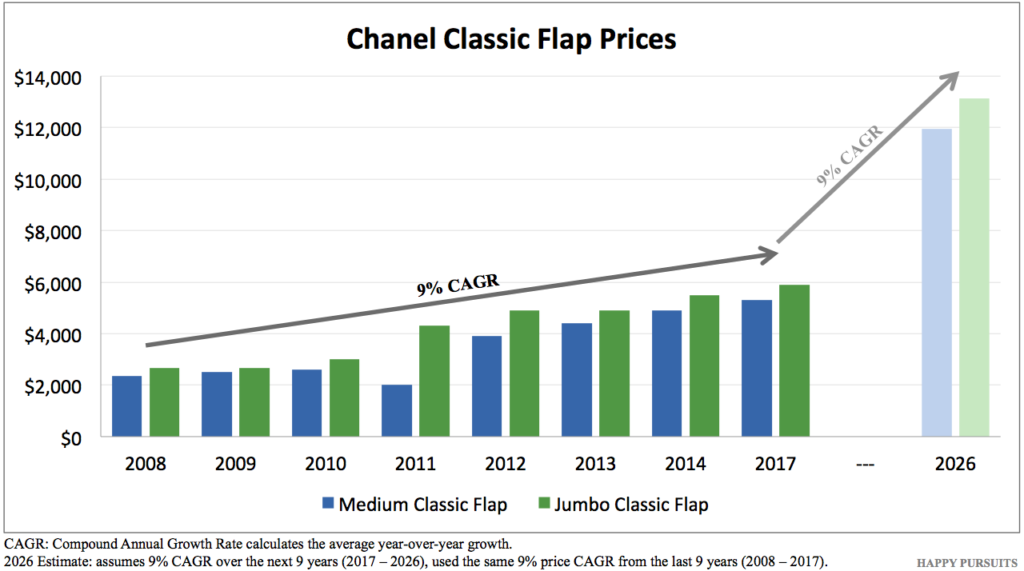

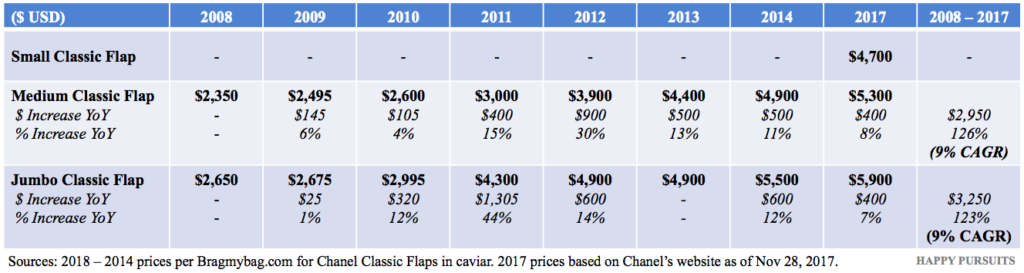

The Chanel Classic Flap was originally called the 2.55 because it was created in Feb 1955. The original 2.55 is comparable to the modern day Classic Flaps (just with a few design updates). The bag costed $220 in 1955, and according to Bag Hunter, adjusting for inflation; the $220 is equivalent to $1,967.17 in July 2016. Yet, in July 2016, the Medium Classic Flap was retailing for $4,900 and Chanel just increased the same bag to $5,300 in Nov 2017. If we just look at the last 9 years, the Medium Classic Flap costed $2,350 in 2008 vs. $5,300 currently; this represents an average price increase of 9% year-over-year. As you can see from the table above, between 2011 and 2014, there was an annual price increase of $400-$900. Prices have stayed constant from 2014 until the recent price increase in Nov 2017. If we apply the same 9% growth rate to 2017 prices, in another 9 years or 2026 then Chanel Classic Flaps will cost more than $10K. You may argue that the price increases have declined on a percentage basis, so 9% growth might be unrealistic. That is true but also remember 2008-2017 has been a period with near zero inflation and Chanel prices still grew that much! Regardless, I think the argument is not if Chanel Classic Flaps will cost $10K because I whole-heartedly believe that it will, the more interesting question is why it would.

If we just look at the last 9 years, the Medium Classic Flap costed $2,350 in 2008 vs. $5,300 currently; this represents an average price increase of 9% year-over-year. As you can see from the table above, between 2011 and 2014, there was an annual price increase of $400-$900. Prices have stayed constant from 2014 until the recent price increase in Nov 2017. If we apply the same 9% growth rate to 2017 prices, in another 9 years or 2026 then Chanel Classic Flaps will cost more than $10K. You may argue that the price increases have declined on a percentage basis, so 9% growth might be unrealistic. That is true but also remember 2008-2017 has been a period with near zero inflation and Chanel prices still grew that much! Regardless, I think the argument is not if Chanel Classic Flaps will cost $10K because I whole-heartedly believe that it will, the more interesting question is why it would.

Chanel Classic Flap vs. S&P 500

Before I delve into that, let’s quickly look at the Chanel Classic Flap vs. the S&P 500, a popular comparison by numerous articles and publications. If you are familiar with Chanel then there is a high probability you’ve read articles such as “Chanel Classic Flap Beats the S&P 500” or “Chanel Classic Flap is a Better Investment Than the S&P 500”. I want to quickly address this.

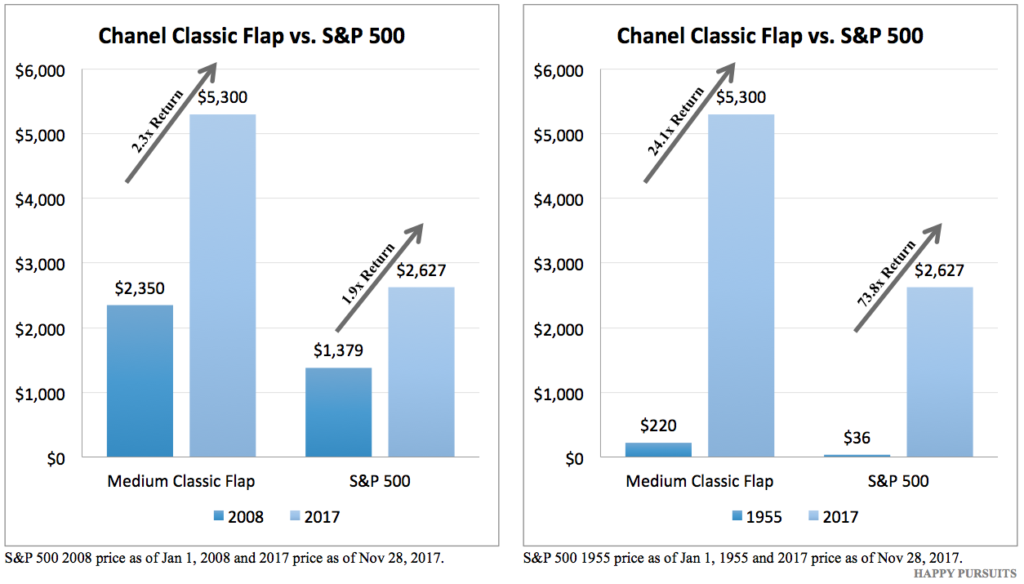

Chanel Classic Flaps may “outperform” the S&P 500 if you look at the retail price in the short term but not the long term. For example, in the short term (e.g., 2008 – 2017), the Medium Classic Flap increased 2.3x while the S&P 500 returned 1.9x. However, in the long term (e.g., 1955 – 2017), the Medium Classic Flap increased 24.1x while the S&P 500 increased 73.8x. It’s important to remember in the short term, the Chanel Classic Flap only beats the S&P 500 because we are assuming you can sell the bag at the full retail price and with no transaction cost.

Chanel Classic Flaps may “outperform” the S&P 500 if you look at the retail price in the short term but not the long term. For example, in the short term (e.g., 2008 – 2017), the Medium Classic Flap increased 2.3x while the S&P 500 returned 1.9x. However, in the long term (e.g., 1955 – 2017), the Medium Classic Flap increased 24.1x while the S&P 500 increased 73.8x. It’s important to remember in the short term, the Chanel Classic Flap only beats the S&P 500 because we are assuming you can sell the bag at the full retail price and with no transaction cost.

If I purchased a Chanel Classic Flap in 2008 say for $2.4K after tax, the chance of me selling it for $5.3K in 2017 is highly unlikely. The bag has to be in perfect condition and even then think about the selling fees. If you consign the bag, a consignment shop will take a hefty cut. Even if you sell on eBay, you will have to pay a ~13% fee (10% eBay and ~3% PayPal). Say I sell the bag for $5.3K after 13% fees, I am left with $4.6K or 1.9x my original $2.4K, or equal-performance to the S&P 500. You can argue that if I had seasonal colors then it might sell for higher than retail, but then again I didn’t assume price cuts due to wear & tear. Regardless, a handbag should never be thought of as an investment like stocks or bonds or real estate because a handbag really is just a handbag.

5 Reasons Why Chanel Classic Flaps will Cost $10K+

Okay now to the main part of the post on why I think Chanel Classic Flap will cost $10K.

- There are Precedents: Hermes Birkin, Hermes Kelly, Hermes Constance

The top case studies for Channel Classic Flaps reaching $10K are Hermes handbags. The Hermes Birkin, Hermes Kelly, and Hermes Constance are all handbags commanding price premiums of $10K+ and are still notoriously popular. When you read forums and watch YouTube videos, you will see buyers trying everything to get their hands on one. Hermes doesn’t actively court customers to buy these handbags; in fact, Hermes turns away customers who are very willing to pay $10K. Hermes plays the long-term game of controlling its supply so the $10K price point is more “justified” (also think of De Beers and diamonds). When Hermes finally offers its customers a Birkin or Kelly the customer is so thankful that Hermes selected them – regardless of what you think of the Birkin or Kelly or Hermes you’ve got to give Hermes credit for its brilliant business strategy and execution.Now back to Chanel, I’m sure Chanel is looking at Hermes and is exactly trying to replicate its strategy of ultra-premium branding and top-tier pricing. Hermes handbags demonstrate market appetite for handbags in the $10K+ price range. Although you may argue that Hermes Birkin and Kelly have superb quality and therefore should be priced higher than a Chanel Classic Flap, I’m sure if Chanel spends an additional $1K on each bag then the Classic Flap will feel just as luxury as the Birkin or Kelly.Finally, some Chanel Classic Flaps in exotic materials or specific designs / limited editions cost upwards of $10K+. It won’t be long before the classic lambskin or caviar versions reach that price point as well.

The top case studies for Channel Classic Flaps reaching $10K are Hermes handbags. The Hermes Birkin, Hermes Kelly, and Hermes Constance are all handbags commanding price premiums of $10K+ and are still notoriously popular. When you read forums and watch YouTube videos, you will see buyers trying everything to get their hands on one. Hermes doesn’t actively court customers to buy these handbags; in fact, Hermes turns away customers who are very willing to pay $10K. Hermes plays the long-term game of controlling its supply so the $10K price point is more “justified” (also think of De Beers and diamonds). When Hermes finally offers its customers a Birkin or Kelly the customer is so thankful that Hermes selected them – regardless of what you think of the Birkin or Kelly or Hermes you’ve got to give Hermes credit for its brilliant business strategy and execution.Now back to Chanel, I’m sure Chanel is looking at Hermes and is exactly trying to replicate its strategy of ultra-premium branding and top-tier pricing. Hermes handbags demonstrate market appetite for handbags in the $10K+ price range. Although you may argue that Hermes Birkin and Kelly have superb quality and therefore should be priced higher than a Chanel Classic Flap, I’m sure if Chanel spends an additional $1K on each bag then the Classic Flap will feel just as luxury as the Birkin or Kelly.Finally, some Chanel Classic Flaps in exotic materials or specific designs / limited editions cost upwards of $10K+. It won’t be long before the classic lambskin or caviar versions reach that price point as well. - Price as a Point of Differentiation

Differentiation is no longer limited to design, quality, or heritage; price is now a key point of differentiation for brands. Affordable luxury brands including Tory Burch, Michael Kors, Coach, and Kate Spade are becoming increasingly popular. The next tier of luxury brands including Saint Laurent, Givenchy, Gucci, and Celine are all trying to differentiate by increasing its prices and move upmarket. Then brands like Chanel and Hermes are trying to distance themselves from those luxury brands and establishing themselves as the ultra-luxury brands by increasing prices.

Differentiation is no longer limited to design, quality, or heritage; price is now a key point of differentiation for brands. Affordable luxury brands including Tory Burch, Michael Kors, Coach, and Kate Spade are becoming increasingly popular. The next tier of luxury brands including Saint Laurent, Givenchy, Gucci, and Celine are all trying to differentiate by increasing its prices and move upmarket. Then brands like Chanel and Hermes are trying to distance themselves from those luxury brands and establishing themselves as the ultra-luxury brands by increasing prices.

Differentiation via pricing is a self-fulfilling strategy. Humans are born with a desire to be unique but we still want to belong and be recognized. In terms of handbags, we like to individualists and buy things that not a lot of others have but at the same time we want to be recognized and connected to other humans so we buy classic designs. Conspicuous consumptions is perhaps part show-off and part human evolution – we all want to show that we are doing well. It might have started as having specific traits and turned into having herds of cattle to now having specific handbags.Regardless, brands play on human nature perfectly and use pricing as a self-fulfilling strategy. Higher prices will limit the number of buyers therefore increase exclusivity, higher exclusivity increases desire to have these handbags and therefore increases demand and supports the higher prices. Fairness aside, price is an efficient tool for differentiation; appreciation for designs or heritage can be subjective but price tags are not. - Chanel as a Veblen Good

Chanel Classic Flap is a classic (pun unintended) example of a Veblen good. Veblen good is defined as a good in which demand increases as the price increase because of its exclusive nature and appeal as a status symbol. The term is named after American economist Thorstein Veblen, also known for introducing the term “conspicuous consumption” (consumption of luxuries on a lavish scale in an attempt to enhance one’s prestige.) For Veblen goods, as the price increases, it enhances its status-conscious appeal.Increasing demand by increasing prices might sound counterintuitive but brands have spent millions of dollars marketing to us to make the premium feel “natural” or “justified”. Besides Chanel, companies like BMW, Rolex, and Tiffany have spent decades crafting and marketing the superiority of their brand to consumers. Status symbol might sound vain and ridiculous but status symbol is as old as humanity; regardless if it’s a crown indicating royalty or estates indicating power or luxury products indicating wealth, humans look at material goods as an indicator of status.

Chanel Classic Flap is a classic (pun unintended) example of a Veblen good. Veblen good is defined as a good in which demand increases as the price increase because of its exclusive nature and appeal as a status symbol. The term is named after American economist Thorstein Veblen, also known for introducing the term “conspicuous consumption” (consumption of luxuries on a lavish scale in an attempt to enhance one’s prestige.) For Veblen goods, as the price increases, it enhances its status-conscious appeal.Increasing demand by increasing prices might sound counterintuitive but brands have spent millions of dollars marketing to us to make the premium feel “natural” or “justified”. Besides Chanel, companies like BMW, Rolex, and Tiffany have spent decades crafting and marketing the superiority of their brand to consumers. Status symbol might sound vain and ridiculous but status symbol is as old as humanity; regardless if it’s a crown indicating royalty or estates indicating power or luxury products indicating wealth, humans look at material goods as an indicator of status. - Price Increases Make A Lot of Business Sense

As a business, Chanel’s main goal is to generate as much revenue as possible in the short term without hurting the long-term prospects of the brand. Companies can drive revenue growth by selling more units or increasing prices. As mentioned, the appeal for designer brands lies in its exclusivity, so selling more units will have an adverse effect on the brand. As a result, increasing prices is a much better strategy. More important than revenue is a Company’s strategy to maximize profits.

As a business, Chanel’s main goal is to generate as much revenue as possible in the short term without hurting the long-term prospects of the brand. Companies can drive revenue growth by selling more units or increasing prices. As mentioned, the appeal for designer brands lies in its exclusivity, so selling more units will have an adverse effect on the brand. As a result, increasing prices is a much better strategy. More important than revenue is a Company’s strategy to maximize profits.

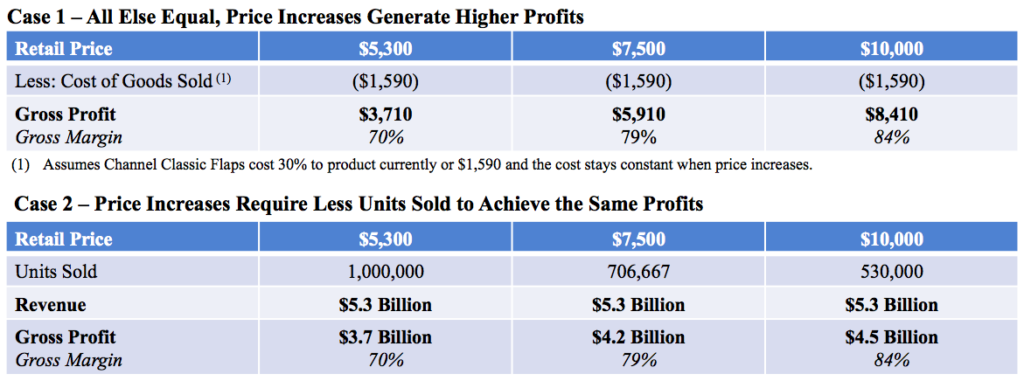

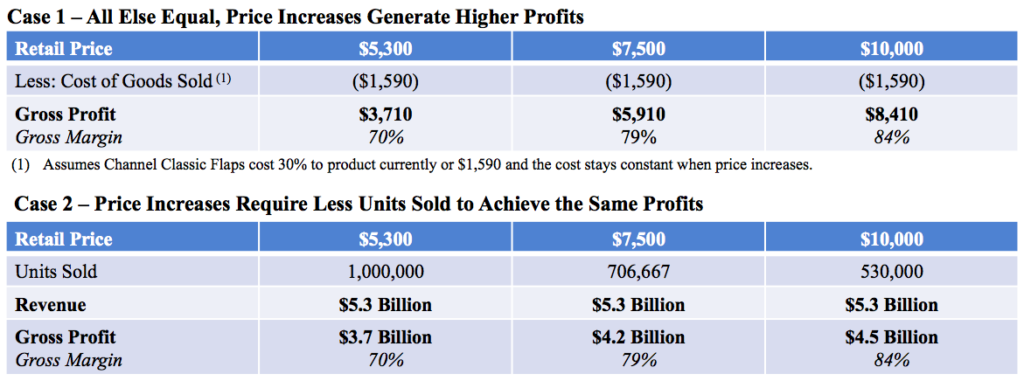

Case 1 is intuitive – if Chanel increases its prices on the Classic Flaps then it will generate higher gross profit (assuming all else equal). If we assume each handbag costs $1.6K to produce (or 30% of current revenue) then Chanel will generate $3.7K in gross profit at its current retail price of $5.3K but if it increases its price to $10K then it will generate $8.4K in gross profit. In another words, even if Chanel sells 2 bags now at $5.3K, it will make less profit than if it sells 1 bag at $10K. With higher margins, Chanel can spend more on improving the quality of its products or marketing to sustain its luxury branding.

Case 2 is also intuitive – if Chanel wants to generate the same amount of revenue say $5.3 billion then it will have to sell 1 million units at $5.3K or only 530K units at $10K. Selling 530K units is better for Chanel’s long-term strategy because the market won’t be flooded with Chanel Classic Flaps therefore making it a less “aspirational” handbag. Furthermore, from an operation perspective, a CEO would pick producing a smaller quantity of goods to generate the same revenue and higher margins any day.By pricing Classic Flaps at a premium, Chanel will help to sell its seasonal handbags that are more affordable. If a Classic Flap costs $10K and similar seasonal handbags cost $3K-$5K then the seasonal bag would “feel” like a great bargain. It also helps to sell complementary products such as ready-to-wear, accessories, and beauty products. As a result, Chanel is able to maximize revenue without decrease the appeal of its brand. Think of lost leaders in grocery stores (i.e. products priced super low to lure in customers so they will also buy higher priced products), Chanel Classic Flaps are exactly the opposite – it is priced at a premium to lure customer yearnings so even if customers can’t afford to buy the Classic Flap, they will happily buy a $500 card case.

Lastly, a healthy pre-love market helps to fuel the primary retail market because it is a validation that Chanel Classic Flaps are valuable. Consistent price increases and limiting retail sales help to improve the pre-loved market. Sometimes I think of Chanel as a stock exchange where the traders (or customers) are only allowed to buy but not short the stocks (or handbags).

- Target Customers Might Not Mind the Price Increase

Increasing prices turns off many consumers, myself included. It can be infuriating if you are saving up for the Chanel Classic Flap and the prices increase on you time and time again. Price increases without doubt will alienate customers. On PurseForum, you see comments like “I’m done with Chanel” or “the prices are insane, I will never buy anymore Chanel handbags”.However, maybe it’s not Chanel maybe its us – we might not be Chanel’s target market (at this time). Chanel’s goal is to be an aspirational brand. It doesn’t want everyone to have its Classic Flaps where eventually the Classic Flaps become so common that they are no longer special. In fact, Chanel is hurt by the popularity of the Classic Flap, some potential customers won’t buy the bag because they see dozens of Classic Flaps therefore a lot of wealthy customers are turning to Hermes.Price increases have to be done right and tastefully, unfortunately here isn’t a secret formula. Every time Chanel increases prices, it will alienate a lot of potential buyers but it will also create a long tail for new buyers in the future and increase its aspirational appeal in the long run.Chanel’s target market is likely the ultra wealthy and upper class customers where $10K is chunk change. It might be the wealthy millennials who are expected to inherit more than $30 trillion from their baby boomer parents (Business Insider). It might be us when we age and our disposable income increases. Say your net worth is $10K right now, spending $5K on a Chanel would be absurd. However, say in 10 years when your career is going well and your net worth is $300K+ then spending $10K on a Chanel handbag as a reward doesn’t seem to be an overstretch.

Will the Cycle Eventually Break? Will Chanel Classic Flaps Always be Popular?

Past is a good indicator of the future but it might not always be an accurate predictor. For decades, Chanel Classic Flaps have been popular and coveted. It took decades of branding and millions in marketing and I’m sure Chanel will continue to spend millions to maintain its position. Chanel Classic Flaps will likely continue to be popular and sought after. As long as there are some customers who like the design and appreciate its history then Chanel will continue to command premium pricing. Think of the to-be-wealthy millennials and the new millionaires from developing nations – a large addressable market for Chanel.

Yet, potential culture changes might decrease the popularity of luxury products. Younger generations are less interested in material goods and place more value in intangibles such as travel, experience, services, life style, education, high-tech etc.

As much as I don’t want to age, I can’t wait to revisit this post in 10 years and see how much Chanel Classic Flaps cost by then. Thank you for reading, hope you found this long post interesting!